10 Simple Techniques For Frost Pllc

Table of ContentsFrost Pllc Things To Know Before You BuyThe smart Trick of Frost Pllc That Nobody is Talking About

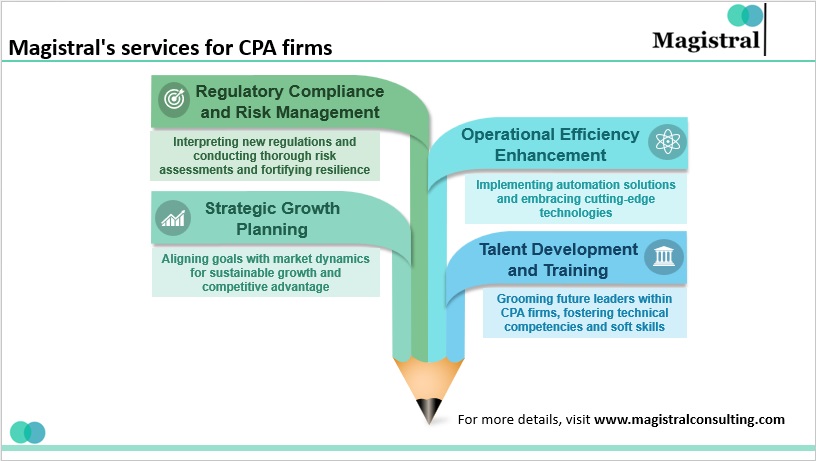

CPAs are the" huge guns "of the accountancy industry and generally do not deal with day-to-day accountancy tasks. You can make sure all your financial resources are current which you're in great standing with the internal revenue service. Working with an accountancy company is an evident selection for complex services that can manage a qualified tax obligation specialist and an exceptional option for any type of small organization that intends to minimize the possibilities of being audited and unload the burden and headaches of tax obligation declaring. Open rowThe difference in between a CPA and an accounting professional is merely a legal difference. A certified public accountant is an accountant licensed in their state of operation. Only a certified public accountant can use attestation services, act as a fiduciary to you and act as a tax attorney if you encounter an IRS audit. Despite your circumstance, even the busiest accounting professionals can ease the moment worry of submitting your tax obligations on your own. Jennifer Dublino contributed to this short article. Resource interviews were performed for a previous variation of this article. Accounting business may likewise utilize CPAs, however they have other types of accountants on team as well. Usually, these other sorts of accountants have specialties throughout areas where having a certified public accountant permit isn't required, such as management bookkeeping, nonprofit accountancy, expense accountancy, government accountancy, or audit. That doesn't make them less certified, it just makes them in a different way qualified. In exchange for these more stringent guidelines, Certified public accountants have the lawful authority to authorize audited monetary statements for the functions of approaching financiers and securing Read Full Report funding. While accountancy companies are not bound by these exact same guidelines, they need to still abide by GAAP(Generally Accepted Accountancy Principles )best methods and show highmoral standards. Because of this, cost-conscious small and mid-sized firms will frequently make use of an accounting services company to not only fulfill their accounting and bookkeeping demands currently, but to range with them as they expand. Don't let the perceived reputation of a firm complete of CPAs distract you. There is a false impression that a certified public accountant company will certainly do a much better task due to the fact that they are legally enabled to

carry out even more tasks than an accounting firm. And when this holds true, his response it doesn't make any type of feeling to pay the premium that a CPA company will certainly charge. Businesses can save on prices considerably while still having actually high-quality job done by utilizing a bookkeeping solutions company instead. Consequently, using a bookkeeping services firm is frequently a far much better worth than employing a CPA

Frost Pllc Can Be Fun For Anyone

Certified public accountants likewise have knowledge in establishing and developing business policies and treatments and assessment of the useful demands of staffing designs. A well-connected CPA can utilize their network to help the company in numerous tactical and getting in touch with duties, effectively linking the organization to the optimal candidate to fulfill their needs. Following time you're looking to fill up a board seat, take into consideration reaching out to a Certified public accountant that can bring value to your organization in all the methods noted above.

Luke Perry Then & Now!

Luke Perry Then & Now! Alfonso Ribeiro Then & Now!

Alfonso Ribeiro Then & Now! Ross Bagley Then & Now!

Ross Bagley Then & Now! Alexa Vega Then & Now!

Alexa Vega Then & Now! Nadia Bjorlin Then & Now!

Nadia Bjorlin Then & Now!